Cardano saw a decline in network activity and revenue between July and September.

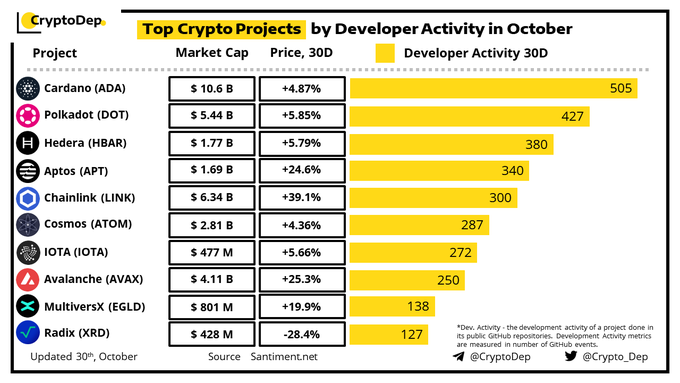

In the last month, the blockchain network has seen the most development activity.

Cardano [ADA] Proof-of-Stake (PoS) Layer 1 network experienced a period of stagnant growth in the third quarter of the year. Most key metrics declined or remained stable over the three-month period, Messari found in a new report .

Read Cardano [ADA] Price Prediction 2023-24

According to the data provider, the network saw a decline in network usage in the third quarter.

Between July and September, the average daily active address count on the blockchain rose to 41,137. This represented a decrease of 29% compared to the 58,000 registered during the second quarter of the year.

The decline in the number of Cardano users caused the number of transactions to fall in the third quarter. The Layer-1 network recorded an average daily transaction count of 60,356 during the quarter, representing a 12% drop from the 69,000 recorded between April and June.

Additionally, the average transaction fee paid by Cardano users to complete transactions on the network fell. According to Messari, the network's average transaction fee denominated in US dollars decreased 21% from $0.13 to $0.10 during the quarter.

Similarly, fees denominated in the network's native ADA token also fell 3% quarter-on-quarter (QoQ).

As a result of falling transaction fees, Cardano's revenue plummeted. Messari found that in the third quarter network revenue fell 30%.

As for the network's decentralized finance (DeFi) vertical, its total value locked (TVL) remained stable.

According to Messari:

“TVL (quarterly) remained stable, decreasing 0.1% quarter-on-quarter. Cardano's TVL ranking among all networks increased from 21st to 15th during the third quarter (starting at 34th at the beginning of the year). This shows that while TVL did not grow in absolute dollar terms, it did grow relative to other ecosystems. “TVL (USD) remaining stable despite ADA’s nearly 10% quarter-on-quarter price drop suggests growth and asset diversification.”

Interestingly, while decentralized applications (dApps) hosted on Cardano saw a 15% decline in average transaction count, the chain's NFT vertical saw its trading volume increase by almost 20% during the quarter.

Between July and September, Cardano recorded an average daily NFT trading volume of $600,000.

Is your wallet green? Review the ADA Earnings Calculator

Any respite?

In the last month, Cardano led other blockchain networks in terms of developer activity. This metric provides insight into a crypto project's commitment to creating a working product and the likelihood of delivering new features.

High Development Activity often reduces the chance that the project is an exit scam. Often measured at GitHub events, Cardano developer activity totaled 505 in the last 30 days.

This is an automatic translation of our English version.